Many people have a false idea about social security. They think they are paying into a forced retirement program. They think the government has an account with their name on it. The government is investing the money for them and them paying their retirement from that account. That entire idea is false.

FICA stands for Federal Insurance Contributions Act. It passed in 1935. Think of it as an insurance policy. You and your employer pay premiums. Benefits are paid to those who qualify. The benefits and qualifications change over time. The first person to receive monthly benefits was Ida May Fuller. She worked for three years under the system. Her total payments accumulated to $24.75. She began collecting benefits of $22.54 per month in January of 1940. She lived to be over 100 years old and died in 1975. She collected $22,888.92 during her lifetime. When someone tells you that you paid into social security and it is your money, send them a link to this article and straighten them out. It is not your money. You are just paying premiums.

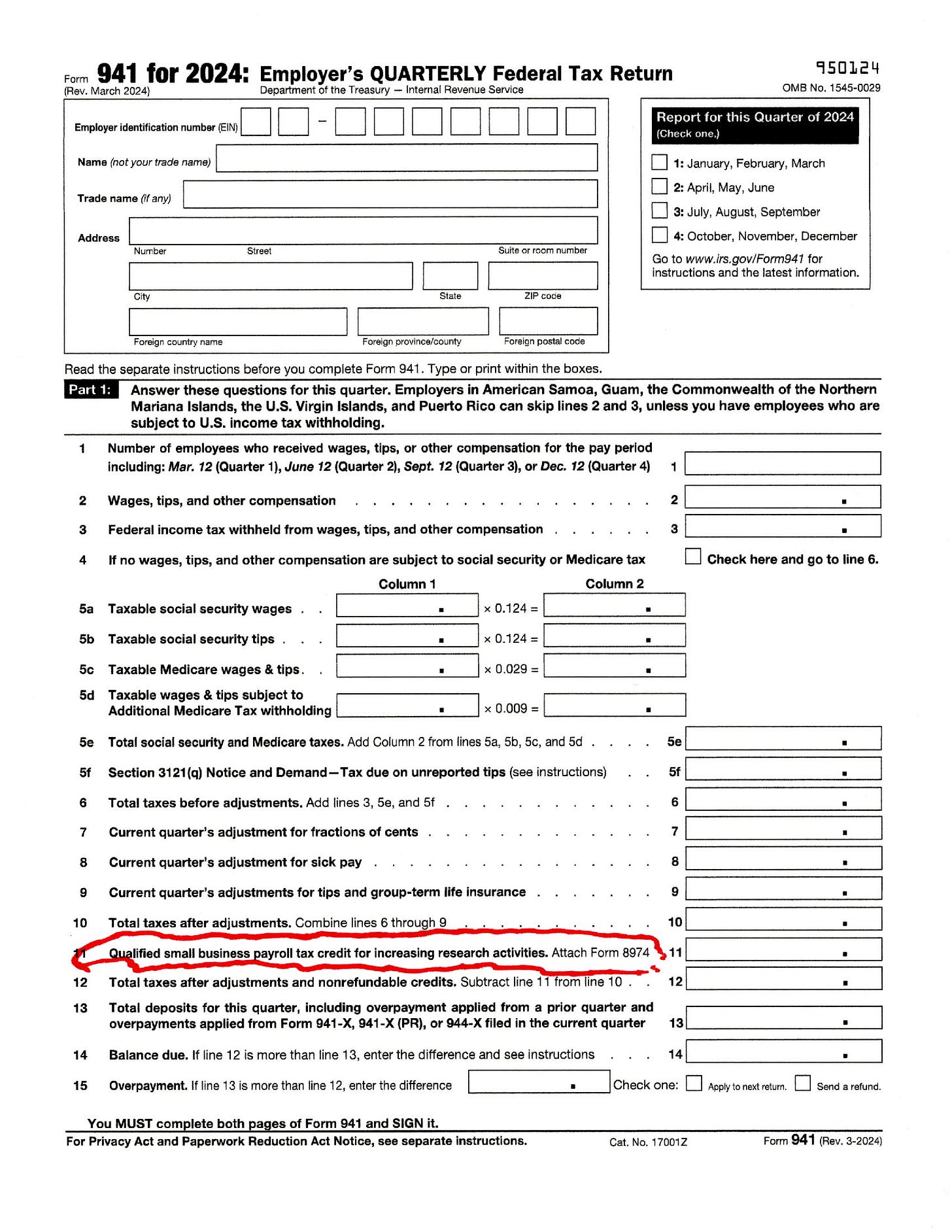

For those of you who don’t file payroll taxes in the U.S., I provided a copy of Form 941 as the picture for this post. I don’t file often. My son and I have a real estate business, and we pay ourselves occasionally through that business. We pay social security and Medicare taxes on our income. Form 941 is used to pay the IRS the income tax withheld from wages and both the employer’s and employee’s side of social security, Medicare.

Imagine my surprise when I was filing Form 941 and got to line 11. “Qualified small business payroll tax credit for increasing research activities.” What? I had to look it up.

You can click on the link to read the entire article at the IRS website. This is a classic example of politicians raising taxes and then giving their benefactors deductions. Notice the date was 2015. The deduction was prior to Trump’s term. As usual the title is misleading. “Protecting Americans from Tax Hikes” is allowing companies to deduct a portion of their increased research activities from their income taxes. If they don’t owe enough in tax, they can deduct it from the employer’s side of social security. The maximum amount to be deducted was $250,000 in 2015 and was increased to $500,000 after December 31, 2022.

Our politicians allowed certain corporations to NOT PAY their portion of OUR social security premium. What happens if insurance doesn’t take in enough in premiums to pay out benefits? That’s right, benefits must be cut.

I would be outraged if not for the fact that I’ve come to expect shenanigans like that.

What happens if insurance benefits are increased? Insurance runs out of money. I learned that we are giving Ukrainians social security. What? I couldn’t believe it. I had to look it up. “On May 21, 2022, the President signed H.R. 7691, the Additional Ukraine Supplemental Appropriations Act, 2022, which became Public Law 117-128.”

So, when our politicians yell and shake their fists about President Trump attacking your social security, remember two things: 1. It is NOT YOUR money. 2. They already gave it away by failing to collect premiums and giving benefits to people who shouldn’t be receiving them.

Eye opener !!